Удиртгал #

Хэрвээ арилжаа хийж эхэлж байгаа бол та спот арилжааны хувилбарыг ашиглах нь хамгийн оновчтой юм.

Энэхүү арилжааны хувилбар нь авах, зарах тал өөрсдийн ханшийг тогтоож, хоёр тал нэг ханшийг зөвшөөрсөн тохиолдолд солилцоо хийгддэг хялбар зарчмаар явагддаг юм. Жишээ нь: Та АрдКойн 200 төгрөгөөр авах бол танд 200 төгрөгөөр зарах тал байж солилцоо хийгдэх боломжтой болно

Спот зах зээл гэж юу вэ? #

Спот зах зээл гэдэг нь хөрөнгө шууд арилжаалагддаг олон нийтэд нээлттэй санхүүгийн зах зээл юм. Худалдан авагч нь хөрөнгийг худалдагчаас фиат эсвэл бусад солилцооны хэрэгслээр худалдаж авдаг.

Spot markets are also known as cash markets because traders make payments upfront. Spot markets come in different forms, and third parties, known as exchanges, typically facilitate trading. You can also trade directly with others in over-the-counter (OTC) trades.

Спот арилжаа гэж юу вэ? #

Спот арилжаа гэдэг нь арилжааны хамгийн энгийн хувилбар бөгөөд авах, зарах хоёр тал одоогийн зах зээлийн ханшаар хөрөнгө солилцох боломжтой арилжааны хувилбар юм. Энэхүү арилжаа нь бидний сайн мэдэх Монголын хөрөнгийн бирж, Улаанбаатар үнэт цаасны биржийн арилжаа болон арилжааны банкны валютийн арилжаатай ижил зарчмаар явагддаг юм.

Спот арилжааны захиалга өгөх хоёр төрлийн хувилбар байна:

Лимит - Ханшийг тохируулан арилжих буюу өөрийн хүссэн тоо хэмжээгээр хүссэн ханшаар арилжаа хийх хувилбар юм. Энэ нь таны захиалгын ханш болон тоо хэмжээ зах зээлийн ханш, тоо хэмжээтэй нийцсэн тохиолдолд захиалга биелэх юм. Маркет - Зах зээлийн ханшаар арилжих буюу өөрийн хүссэн тоо хэмжээгээр зах зээл дээрх нээлттэй байгаа бүх захиалгуудаас арилжаа хийх хувилбар юм. Энэ нь арилжааны ханш зах зээлээс хамаарч байгаа тул ялгаатай ханшууд дээр захиалга биелэх юм.

Спот арилжааны давуу тал Спот арилжаа нь ханш ирээдүйд өснө гэсэн таамаглалаар бага үед нь худалдан авч хадгалах эсвэл ханшийн зөрүү үүсэхэд зарах зэргээр эргүүлэн ашиг хийх боломжтой байдаг. Захиалгын ханшууд хоорондоо тохирсон тохиолдолд солилцоо шууд хийгддэг тул зах зээл идэвхтэй хөдөлгөөнд байдаг.

Спот арилжаа хэрхэн хийх вэ? #

Спот арилжаа гэдэг нь арилжааны хамгийн энгийн хувилбар бөгөөд авах, зарах хоёр тал одоогийн зах зээлийн ханшаар хөрөнгө солилцох боломжтой арилжааны хувилбар юм. Энэхүү арилжаа нь бидний сайн мэдэх хөрөнгийн зах зээлийн үнэт цаасны арилжаа болон валютийн арилжаатай ижил зарчимаар явагддаг юм.

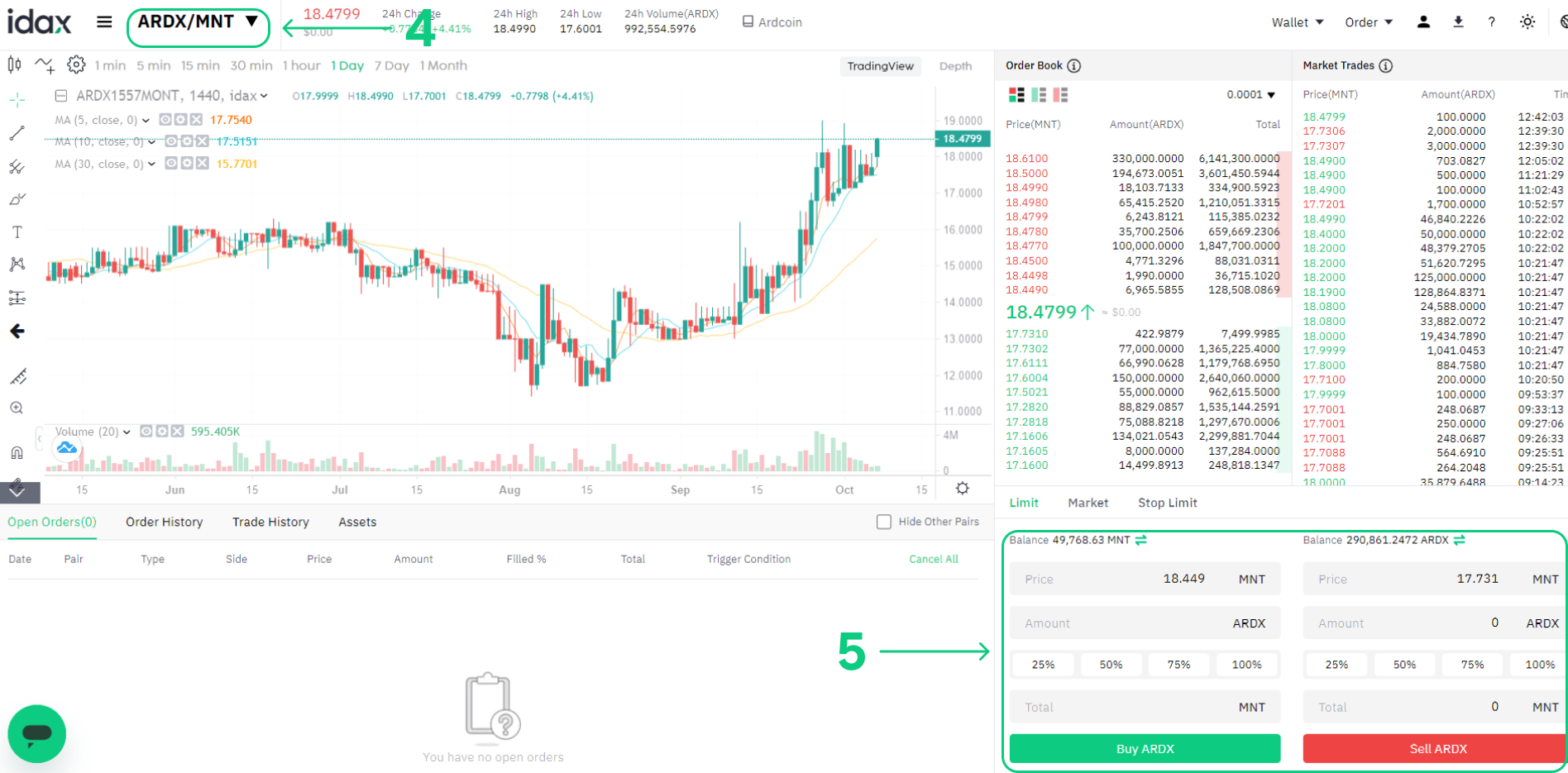

Users can prepare spot trades in advance to trigger when a specific spot price is reached, known as a limit order. You can make spot trades on idax through our trading page interface

idax дээр спот арилжаа хэрхэн хийх вэ? #

1. Арилжаа хийхийн тулд та бүртгэлтэй хаягаараа нэвтэрч орно. [Нэвтрэх] at the top right corner.

2. Нүүр хэсэгт харагдаж буй арилжааны түлхүүр мэдээлэл дээр дарахад спот арилжааны хуудас руу үсрэх бөгөөд [Бүх хослол харах] сонголтыг дарахад бүх спот болон ETF арилжааны түлхүүр мэдээлэл харагдах юм. View more markets at the bottom of the list.

3. АрдКойн ARDX худалдан авахын тулд [Арилжаа] хэсэгт дарж орон арилжааны цонхыг нээнэ. [Trade] option.

- Go to the buying section to buy ARDX and fill in the price and the amount for your order. Click on [Buy ARDX] to complete the transaction.

- The default order type is a limit order. If traders want to place an order as soon as possible, they may switch to [Market] Order. By choosing a market order, users can trade instantly at the current market price.

- If the market price of ARDX/MNT is at 20, but you want to buy at a specific price, for example, 10, you can place an [Limit] order. When the market price reaches your set price, your placed order will be executed.

- The percentages shown below the ARDX [Amount] field refer to the percentage amount of your held MNT you wish to trade for ARDX. Pull the slider across to change the desired amount.

How to Resolve Order Issues #

Occasionally you may encounter problems with your orders when trading on idax. We can divide these into two categories:

1. Your trade order is not executing

- Check the selected order’s price in the open orders section. Verify whether or not it has matched a counterparty’s order (bid/ask) with this price level and volume.

- If you would like to expedite your order, consider canceling it from the open orders section and submitting a new order at a more competitive price. For a quick settlement, you may also consider using a market order.

2. Your order has a more technical issue:

Issues like the inability to cancel your orders or coins not being credited to your account require further support. Please contact our Customer Support team and provide screenshots that’ll document:

- The order’s details

- Any error code or exception message